RxDC Reporting Deadline Approaching

March 20, 2024

The next round of RxDC reporting for the year 2023 is due June 1, 2024, which is fast approaching. This is an annual reporting requirement due June 1 of the year following the calendar year being reported (also known as the reference year).

Many employers, especially those with fully-insured plans, got away without having to do anything in the first round of reporting because their carrier/TPA/PBM was able to handle the reporting for them. But that is going to change in the next round of reporting because of a change in what information is required to be reported. Going forward we expect that all employers offering a group health plan, regardless of size and funding vehicle, will have some role to play in the RxDC process.

| Carrier | RxDC Reporting Process | Supporting Documentation |

|---|---|---|

| Aetna | The data collection form must be completed NO LATER THAN 4/12/2024 Prescription Drug Data Collection (RxDC) reporting for reference year 2023 is required to be submitted no later than 6/1/2024 and must include certain data elements collected annually. Therefore, Aetna has developed a process to support our plan sponsors in the submission of these reports. What you need to do: Complete the form emailed to you no later than 4/12/2024. If you have not received an email with the form, please contact your account manager for assistance. We are collecting information for reference year 2023. The reference year is the calendar year immediately preceding the calendar year in which the RxDC report is due. Complete one form per unique combination of Legal Entity and Funding Arrangement. You will need to complete the following fields: Submitter First Name, Last Name, and Email

Legal Entity Name (Required)

Funding Arrangement (Required)

Total Premium Paid by Members (Required)

Total Premium Paid by Employer (Required)

To learn more, CMS Reporting Instructions Section 6, beginning on page 20, addresses calculations for Premium and Life-Years. If a self-insured plan sponsor requests to be excluded from Aetna’s D1 file, you do not need to complete this data collection process. Instead, contact your account representative to request an exception. | How to Complete the RxDC Plan Sponsor Data Collection FormHow to Complete the RxDC Plan Sponsor Data Collection Form |

| Aetna International | Pending | |

| AmeriHealth | For the June 1, 2024 and subsequent Section 204 – RxDC submission to CMS, AmeriHealth will collect information for Form 5500 Plan Code, the employee contribution information, and the PBM name through the Employer Portal. The employee contribution is required from all customers (self-funded, level-funded, and insured). The employer contribution will be calculated based on the total premium or premium equivalent and employee contribution. AmeriHealth will produce and submit the D1 file, as a service to our self-funded customers, based on the data AmeriHealth currently has within its systems for the timeframes required for the reports. | Consolidated Appropriations Act (CAA) and Transparency in Coverage Rule (TCR) Overview and Frequently Asked Questions |

| Capital Blue Cross | Capital Blue Cross continues to comply with the Consolidated Appropriations Act (CAA) drug cost reporting requirements. We have posted on our website our plan to collect and submit files for ASO small business and fully insured group customers, on their behalf, for calendar year 2023. Capital will also submit on the behalf of ASO groups if they opt in for us to do so. All ASO small business and fully insured group customers and ASO groups who choose to have Capital report on their behalf need to complete this form by March 29 so we can get the required data that only the groups can provide (such as the average monthly premium paid by members). Should you require it, there is a different form specific to producers. Please check under the Drug cost reporting tab on our website to see what steps we’re taking to complete this submission and what action is needed. Contact your account executive with any questions. | N/A |

| Cigna | To comply with the CAA Section 204 final rule, Cigna Healthcare is submitting files on its clients' behalf, at no additional cost to the clients. This is the standard option for self-funded and fully insured clients. What Cigna Healthcare will do:

What Cigna Healthcare will not do:

| Prescription drug and health care spending report |

| Highmark Delaware | Background Section 204 of the Consolidated Appropriations Act, 2021 (CAA) requires health insurance issuers and self-insured group health plans to submit information regarding prescription drug spending, health care spending, and enrollment each year to the Centers for Medicare and Medicaid Services (CMS) on an annual basis. This information must be submitted in specific file formats to CMS for the 2023 calendar year by June 1, 2024. Similar to 2023, health insurance issuers (on behalf of Fully Insured groups) and Self-Funded group health plans must report actual premium amounts paid by the employer and actual premium amounts paid by members. Like most health insurance issuers and TPAs, Highmark does not collect this information from clients. We will continue to leverage a survey to collect the required premium information from both Fully Insured and Self-Funded group clients. Additional detail regarding the data collection process can be found in the attached Prescription Drug Data Collection (RxDC) Overview. Additionally, the Prescription Drug Data Collection (RxDC) Survey Worksheet provides more detail on individual data elements that must be submitted. Action Required Fully insured clients and ASO clients that would like Highmark to submit premium data to CMS on their behalf must submit all of the required information to Highmark by no later than May 1, 2024 via the Prescription Drug Data Collection (RxDC) Survey.

| |

| Horizon BlueCross/BlueSheild of New Jersey | Horizon’s Approach to the CAA RxDC 2023 Reporting for Fully Insured and Level-Funded Groups Under Section 204 of the Consolidated Appropriations Act, 2021 (CAA), insurance companies and employer-based health plans are required to submit information about prescription drugs and health care spending to the Centers for Medicare & Medicaid Services (CMS). This data submission is called the RxDC (prescription drug data collection) report. This information must be submitted to CMS by June 1, 2024, for 2023 data, and every year after that, through a web portal set up by CMS. What information do insurance companies and employers submit to CMS? The CAA requires insurance companies and employer-based health plans to submit information about:

How will this information be used? The data submitted by insurance companies and employer-based health plans will help to: What do you need to know? Horizon’s approach to CAA RxDC for fully insured groups (including Level-Funded plans) with active prescription drug coverage in 2023 will be consistent with our approach for the reporting years of 2020, 2021 and 2022, submitted to CMS. Horizon will: Horizon WILL NOT: Why is Horizon not collecting information such as monthly premium? Horizon has determined that there is sufficient internally captured data regarding the number of members in an insured plan, the life year’s calculation, premiums paid, rates, contributions, etc. to produce information for the D1 columns. Going forward, Horizon will review any additional clarification and guidance to ensure compliance with the RxDC requirements and will update our approach, if needed for future submissions. We will inform you of any change necessary to the current procedure. If you have questions, please contact your Horizon sales executive or account manager. | N/A |

| Imagine 360 | The Consolidated Appropriations Act (CAA) requires that self-funded group health plans (“Plans”) report information on plan medical costs and prescription drug spending to the Secretaries of Health and Human Services, Labor, and the Treasury (the “Departments”) on an annual basis. The data is used to provide insight into increased spending on prescription drugs. The reporting responsibility lies with the Plan Sponsor, but Third-Party Administrators (“TPA”) and Pharmacy Benefit Managers (“PBM”) have most of the information necessary to submit the required data on behalf of the Plans. There are some data elements that Imagine360 would not have in our systems, which require coordination with you, the Plan Sponsor, to collect. Imagine360 will compile and file with the Departments the following:

The reporting for the 2023 calendar year (CY) data is due June 1, 2024. Imagine360 will only submit the above data for our active and former clients that we administered during any period of CY 2023. Files D3 through D8 need to be submitted to the Departments by the Plan Sponsor or the PBM. Unless otherwise communicated, Imagine360 will not submit PBM files on behalf of the Plan Sponsor. Please complete this FORM by April 24, 2024 to include your information in our reporting. Average premium paid by employers and members is a requirement for calendar year 2023. If it is not submitted by the Plan, then you may be found out of compliance. Calculate the average monthly premium equivalent paid by members by taking the total annual premium equivalents paid by members during the reference year and dividing by 12. The same can be done to calculate the average monthly premium equivalent paid by employers. Take the total annual premium equivalents paid on behalf of members and divide by 12. You should divide by 12 even if the coverage was not in effect for the entire calendar year. As always, we appreciate the opportunity to collaborate with you, and we are happy to address any questions you may have. If you would like to discuss this in more detail, please let me know. Additionally, if you have any questions regarding the data files that reflect prescription drug data only (D3-D8), please reach out to your PBM. The RxDC Reporting Instructions can be found here. | N/A |

| Independence Blue Cross | For the June 1, 2024, and subsequent Section 204 – RxDC submission to CMS, Independence will collect information for Form 5500 Plan Code, the employee contribution information, and the PBM name through the Employer Portal. The employee contribution is required from all customers (self-funded and insured). The employer contribution will be calculated based on the total premium or premium equivalent, and employee contribution. Independence will produce and submit files P2, D1, and D2, as a service to our self-funded customers, based on the data Independence currently has within its systems for the timeframes required for the reports. If the self-funded client has Optum Rx as their PBM, Optum Rx will provide the files D3 through D8 to Independence. Independence will submit all files to CMS in one ‘reporting’ package. For self-funded customers with coverage through a different PBM, data for the D3 through D8 files will not be included. | Consolidated Appropriations Act (CAA) and Transparency in Coverage Rule (TCR) Overview and Frequently Asked QuestionsN/A |

| TripleS | Pending | |

| Trustmark | Plan Data Required by March 28 to Meet Federal Mandates Federal mandates require the submission of data related to prescription drugs and healthcare spending by employer-sponsored health benefit plans in 2023.

Provisions of Consolidated Appropriations Act, 2021, (CAA) apply to your plan even if it is no longer administered by us. Plan sponsors that fail to report this required data may be subject to penalties under both ERISA and the Internal Revenue Code. SUBMIT INFORMATION HERE What action is needed?

| |

| United Healthcare | UnitedHealthcare (UHC) changed the approach for customers or brokers to submit information that will support UHC submission of pharmacy benefits and costs reporting data to CMS by the June 1, 2024, deadline. UHC will not send a survey like we did for 2023 but will require customers to complete a Request for Information (RFI) by March 31, 2024. The RFI will be available beginning February 1, 2024, and must be completed by March 31, 2024. The RFI is embedded in UHC Employer & Broker Portals and can be accessed after the employer or their delegate signs in with their secure passcode. Please complete the questions needed to allow UnitedHealthcare to submit the RxDC data this year (see attached data collection worksheet). We request your support in completing the necessary questions in the CAA Pharmacy Data Collection (RxDC) request for information (RFI) located on the employer/broker portal. This will ensure that UnitedHealthcare can successfully submit the RxDC data report to CMS for any active coverage you have with UnitedHealthcare or our affiliates during the reference year. Your timely response is of utmost importance as the deadline for submitting the information to us is March 31, 2024, so we can prepare the data to submit to CMS by June 1, 2024. Note that UMR and a subset of Surest employers renewing between Feb. 1 and July 1 will receive a survey instead completing the RFI on the employer/broker portal. To facilitate this process please refer to the following helpful resources: RxDC 2024 video, RxDC Guide, and a set of FAQs about RxDC requirements and the process for you to submit data to us. You can watch the video at your convenience, review any information you need, and easily print out any resources for future reference. Background, Process and UnitedHealthcare Approach Each year, UnitedHealthcare submits the P2 (Group Health Plan), D1 (Premium and Life Years), and D2 (Spending by Category) files for all fully insured and self-funded customers who had active coverage with UnitedHealthcare or its affiliates (such as UMR, Surest, and All Savers/Level Funded) during the reference year. For the upcoming submission on June 1, 2024, the reference year is 2023. For employers who have an OptumRx integrated PBM, UnitedHealthcare will also submit the D3-D8 files. However, for employers using any other PBM, including OptumRx Direct, they must coordinate with their PBM to submit the D3-D8 files. It is important for you to complete the RFI (or UMR or Surest survey if you received one) by the March 31 deadline. To save time, we recommend using the RxDC RFI worksheet to gather the required data in advance. Links to the worksheets are in the video, in the RxDC FAQs and on the uhc.com Pharmacy Benefits and Costs web page. Please be aware that the deadline for you or your designee to answer the questions in the RFI (or survey) is March 31, 2024. All responses must be completed and attested for UnitedHealthcare to submit the data to CMS. Partial or incomplete information will not be included. This deadline is non-negotiable. Failure to complete the RFI by this date will result in UnitedHealthcare submitting only the P2/D1 data available in our system for the 2023 reference year reporting period. However, this submission will be considered incomplete, and you will be responsible for any missing reporting data.

If you are a self-funded customer that plans to submit your data to CMS, please contact your UnitedHealthcare representative no later than March 31, 2024. We will provide the data we have to support your submission by mid-May. Note: This option is not available for fully insured employers. | UHC RxDC RFI Worksheet Pharmacy Benefits and Costs Reporting |

Mind Your Ps and Ds

The RxDC reporting requirement takes the form of nine different data files that are submitted to CMS through their HIOS system:

| D1 | Plan Details (vendors, # covered individuals, premiums etc.) |

| D2 | Medical spending information |

| D3-D8 | Drug spending information |

| P2 | Plan identifying information – sort of a cover sheet that identifies which plans are included in the accompanying D files |

Most of the data required to be included in these files is in the possession of the carrier, TPA or PBM so they can handle the filing of those reports without the employer’s input or assistance.[1] The notable exception is the D1 file which contains two fields to report Average Monthly Premium Paid by Members and Average Monthly Premium Paid by Employers.

Most carriers, TPAs and PBMs do not collect and store an individual group’s premium contribution split which means they have to obtain this information from the employer themselves. In the first round of reporting, CMS indicated these data fields were optional so many carriers, TPAs and PBMs just ignored them which is why many employers had no involvement in the first round of reporting.

However, CMS has indicated these fields will be required going forward which means employers will have to supply this information. We have seen two approaches from carriers and TPAs to collect this data from employers.

- The carrier or TPA requires the employer to report the Average Monthly Premium data to them through some online form, email or paper form. They may also request the employer furnish other data required for the D1 at the same time. UHC is typical of this approach – UHC expects all of their groups (fully-insured, self-funded, or level-funded) to complete an online survey providing various data required for the D1 file through an online portal no later than March 3, 2023.

- We have also seen a few carriers and TPAs decide they will simply not file the D1 and the employer will be responsible for submitting that file on its own. We saw this approach amongst a sizable minority of self-funded plan TPAs during the first round of reporting but are now seeing this approach being adopted by some fully-insured carriers as well. If a carrier or TPA takes this approach, the employer will have to register with HIOS and prepare a P2 and D1 file to submit by June 1, 2023.

Calculate Average Monthly Premiums

How does an employer go about calculating the Average Monthly Premium Paid by Members and Employer? The method outlined in the RxDC reporting Instructions involves a three-step process:

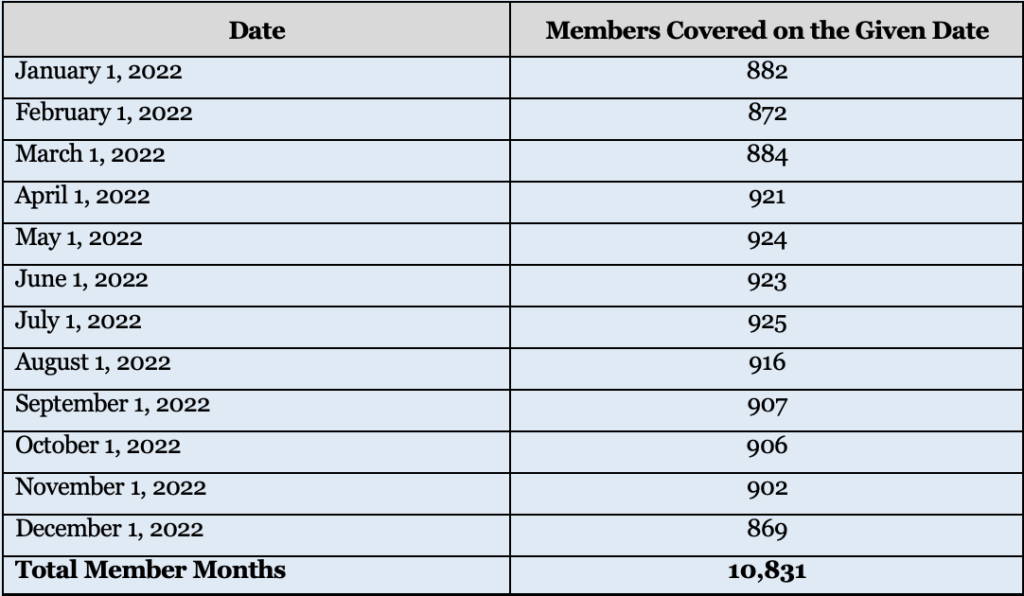

| Step 1: Calculate Total Member Months Choose one day of the month, e.g. 1st of the month, 15th of the month, or last day of the month. For each calendar month in the reference year determine how many members were enrolled in each plan sponsored by the employer on the chosen day that month. “Members” includes not only active employees enrolled in the plan but also dependents, COBRA enrollees, retirees, etc. Add up the 12 monthly member counts – this is Total Member Months for the year. For example: |

| Employers may need to consult census reports from their carrier/TPA to determine the number of members enrolled each month if the employer does not regularly track this information. Given that the RxDC is an annual reporting requirement, employers may want to consider modifying their HRIS or benefit enrollment system to capture total members each month on an ongoing basis rather than poring over census reports after the fact to recreate those numbers |

| Step 2: Calculate Total Premiums Paid by Members and Total Premiums Paid By Employer. Add up all the premiums paid by members over the course of the reference year, regardless of plan option, coverage tier, or rate structure. Then do the same for all premiums paid by the employer over the course of the reference year. For self-funded plans, use premium equivalents taking into account the same costs used to calculate the COBRA rate but not including the 2% COBRA admin fee. CMS has indicated they expect the premium equivalents reported in the D1 file to be the premium equivalents based on actual plan costs for the reference year. For most self-funded plans, the COBRA premiums are calculated at the start of the plan year using expected costs, which is likely a different number than the premium equivalent based on actual plan costs for the reference year that CMS is looking for. |

| Step 3: Calculate Average Monthly Premiums. The Average Monthly Premiums Paid by Members is the total annual premiums paid by members divided by the Total Member Months. Likewise, the Average Monthly Premiums Paid by Employer is then total annual premiums paid by the employer divided by Total Member Months. |

In most cases, an employer should end up with a single amount for Average Monthly Premium Paid by Members and Employer, regardless of how many plans, coverage tiers, or rate structures it maintains. The exception would be if the employer (or the carrier or TPA on the employer’s behalf) is required report different plans on different lines in the D1 file. This may occur, for example, if the employer offers different plans from different carriers or TPAs or if the employer offers a mix of self-funded and fully-insured plans. In that case, the employer will need to calculate a separate Average Monthly Premium for each plan or plans required to be reported on a separate line of the D1 file.

How concerned should an employer be with getting this calculation exactly right? While employers should do their best to provide an accurate answer, in our opinion, any minor errors in the calculation are unlikely to be significant. A carrier or TPA filing a D1 on its groups’ behalf is required to aggregate the Average Monthly Premium across its entire book of business by state and market segment. In other words, CMS will not see any one employer’s data but rather a grand weighted average across hundreds or even thousands of employers. Therefore, a small error in one employer’s data will not have a significant impact on the overall data being reported.

Other D1 Fields

For those employers unfortunate enough to have to complete their own D1 or whose carrier/TPA requests additional information, here are some pointers on how to complete the remaining D1 fields:

| Field Names | Notes |

| Issuer or TPA Name/EIN | This should be the name and EIN of the insurance company who issues your fully insured policy or the TPA who administers your self-funded plan. Do not enter the employer’s name and number, unless the plan is both self-funded and self-administered. Do not enter more than one name or number – if there were multiple issuers/TPAs in the same year, they must be entered on separate lines. |

| State | For a fully insured plan, enter the two-letter postal code for the state where the policy was issued. For a self-funded plan, enter the two-letter postal code for the state of the employer’s principal place of business. |

| Market Segment | The market segments for group plans are: small group market; large group market; SF small employer plans; and SF large employer plans. Use the same definition of “small” used in your state to identify the small group fully insured market (typically less than 50 employees), even for a self-funded plan. Do not enter more than one market segment – if the employer offers multiple plans in different segments, e.g. both a self-funded and a fully insured plan, they should be listed on different lines. |

| Life years | Take the Total Member Months used to calculate Average Monthly Premiums, above, and divided by 12. Report the resulting number to the 8th decimal place. In the example above with 10,831 member months, the life years reported would be 902.58333333. |

| Earned Premium | This is the total amount of premiums paid to the insurance company for a fully-insured plan for the reference year; this field should be blank for a self-funded plan. This should be the same number used in the denominator when calculating Average Monthly Premiums. Do not reduce the premium to reflect MLR or other similar rebates. |

| Premium Equivalents | This is total cost of providing self-funded coverage for the year including claims costs, administrative costs, Administrative Services Only (ASO) and other TPA fees, and stop-loss premiums. Use the same costs that are used to calculate the COBRA premium except CMS expects the employer to use actual costs for the year, not expected costs, and don’t include the 2% admin fee. This should be the same number used in the denominator when calculating Average Monthly Premiums; this field should be left blank for a fully insured plan. |

| ASO/TPA Fees Paid | Report total ASO/TPA fees paid for a self-funded plan for the reference year – this amount should also be included in the premium equivalents amount. This field should be left blank for a fully-insured plan. |

| Stop Loss Premiums Paid | Report total stop loss premiums paid for a self-funded plan for the reference year – this amount should also be included in the premium equivalents amount. This field should be left blank for a fully-insured plan. |

While every effort has been taken in compiling this information to ensure that its contents are totally accurate, neither the publisher nor the author can accept liability for any inaccuracies or changed circumstances of any information herein or for the consequences of any reliance placed upon it. This publication is distributed on the understanding that the publisher is not engaged in rendering legal, accounting or other professional advice or services. Readers should always seek professional advice before entering into any commitments.

[1] But just because they can doesn’t always mean they will. In some cases, the carrier, TPA or PBM have indicated they will supply the necessary data but the employer must actually file the data with CMS themselves. Brokers and employers must check with each carrier, TPA or PBM how much they will file on the employer’s behalf and what portion of the filing remains the responsibility of the employer.