Rx Reporting – Round Two! (Sorry you can’t ignore it this time)

February 24, 2023

We’ve made it through the first round of prescription drug reporting (a/k/a RxDC reporting) required by the Consolidated Appropriations Act. The reports for 2020 and 2021 were initially due December 27, 2022 which deadline was later extended to January 31, 2023.

This is an annual reporting requirement which going forward will be due June 1 of the year following the calendar year being reported (also known as the reference year). So that means the next round of reporting for the year 2022 is due June 1, 2023, which is fast approaching.

Many employers, especially those with fully-insured plans, got away without having to do anything in the first round of reporting because their carrier/TPA/PBM was able to handle the reporting for them. But that is going to change in the next round of reporting because of a change in what information is required to be reported. Going forward we expect that all employers offering a group health plan, regardless of size and funding vehicle, will have some role to play in the RxDC process.

Mind Your Ps and Ds

The RxDC reporting requirement takes the form of nine different data files that are submitted to CMS through their HIOS system:

| D1 | Plan Details (vendors, # covered individuals, premiums etc.) |

| D2 | Medical spending information |

| D3-D8 | Drug spending information |

| P2 | Plan identifying information – sort of a cover sheet that identifies which plans are included in the accompanying D files |

Most of the data required to be included in these files is in the possession of the carrier, TPA or PBM so they can handle the filing of those reports without the employer’s input or assistance.[1] The notable exception is the D1 file which contains two fields to report Average Monthly Premium Paid by Members and Average Monthly Premium Paid by Employers.

Most carriers, TPAs and PBMs do not collect and store an individual group’s premium contribution split which means they have to obtain this information from the employer themselves. In the first round of reporting, CMS indicated these data fields were optional so many carriers, TPAs and PBMs just ignored them which is why many employers had no involvement in the first round of reporting.

However, CMS has indicated these fields will be required going forward which means employers will have to supply this information. We have seen two approaches from carriers and TPAs to collect this data from employers.

- The carrier or TPA requires the employer to report the Average Monthly Premium data to them through some online form, email or paper form. They may also request the employer furnish other data required for the D1 at the same time. UHC is typical of this approach – UHC expects all of their groups (fully-insured, self-funded, or level-funded) to complete an online survey providing various data required for the D1 file through an online portal no later than March 3, 2023.

- We have also seen a few carriers and TPAs decide they will simply not file the D1 and the employer will be responsible for submitting that file on its own. We saw this approach amongst a sizable minority of self-funded plan TPAs during the first round of reporting but are now seeing this approach being adopted by some fully-insured carriers as well. If a carrier or TPA takes this approach, the employer will have to register with HIOS and prepare a P2 and D1 file to submit by June 1, 2023.

Calculate Average Monthly Premiums

How does an employer go about calculating the Average Monthly Premium Paid by Members and Employer? The method outlined in the RxDC reporting Instructions involves a three-step process:

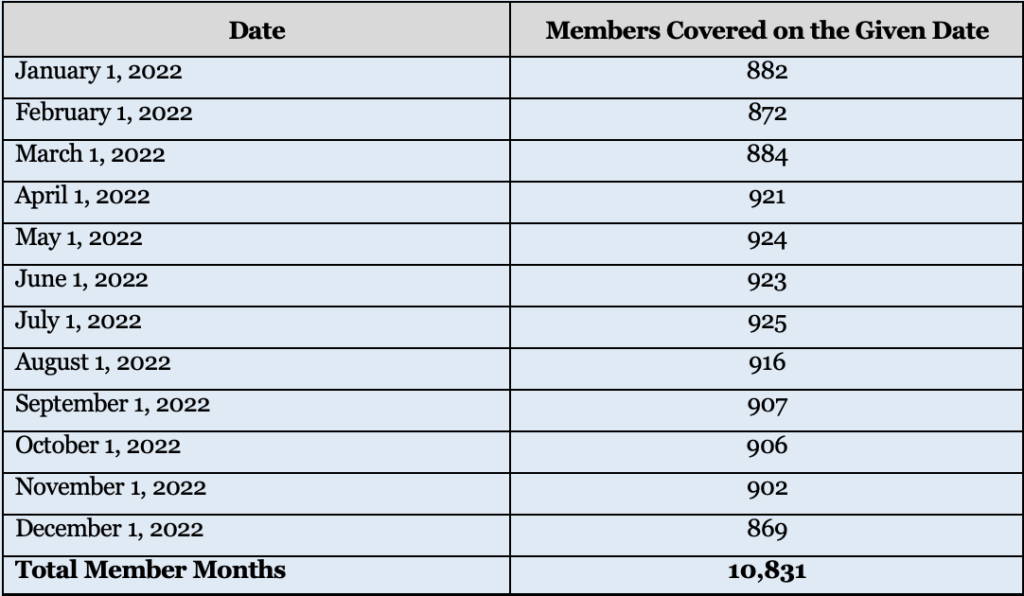

| Step 1: Calculate Total Member Months Choose one day of the month, e.g. 1st of the month, 15th of the month, or last day of the month. For each calendar month in the reference year determine how many members were enrolled in each plan sponsored by the employer on the chosen day that month. “Members” includes not only active employees enrolled in the plan but also dependents, COBRA enrollees, retirees, etc. Add up the 12 monthly member counts – this is Total Member Months for the year. For example: |

| Employers may need to consult census reports from their carrier/TPA to determine the number of members enrolled each month if the employer does not regularly track this information. Given that the RxDC is an annual reporting requirement, employers may want to consider modifying their HRIS or benefit enrollment system to capture total members each month on an ongoing basis rather than poring over census reports after the fact to recreate those numbers |

| Step 2: Calculate Total Premiums Paid by Members and Total Premiums Paid By Employer. Add up all the premiums paid by members over the course of the reference year, regardless of plan option, coverage tier, or rate structure. Then do the same for all premiums paid by the employer over the course of the reference year. For self-funded plans, use premium equivalents taking into account the same costs used to calculate the COBRA rate but not including the 2% COBRA admin fee. CMS has indicated they expect the premium equivalents reported in the D1 file to be the premium equivalents based on actual plan costs for the reference year. For most self-funded plans, the COBRA premiums are calculated at the start of the plan year using expected costs, which is likely a different number than the premium equivalent based on actual plan costs for the reference year that CMS is looking for. |

| Step 3: Calculate Average Monthly Premiums. The Average Monthly Premiums Paid by Members is the total annual premiums paid by members divided by the Total Member Months. Likewise, the Average Monthly Premiums Paid by Employer is then total annual premiums paid by the employer divided by Total Member Months. |

In most cases, an employer should end up with a single amount for Average Monthly Premium Paid by Members and Employer, regardless of how many plans, coverage tiers, or rate structures it maintains. The exception would be if the employer (or the carrier or TPA on the employer’s behalf) is required report different plans on different lines in the D1 file. This may occur, for example, if the employer offers different plans from different carriers or TPAs or if the employer offers a mix of self-funded and fully-insured plans. In that case, the employer will need to calculate a separate Average Monthly Premium for each plan or plans required to be reported on a separate line of the D1 file.

How concerned should an employer be with getting this calculation exactly right? While employers should do their best to provide an accurate answer, in our opinion, any minor errors in the calculation are unlikely to be significant. A carrier or TPA filing a D1 on its groups’ behalf is required to aggregate the Average Monthly Premium across its entire book of business by state and market segment. In other words, CMS will not see any one employer’s data but rather a grand weighted average across hundreds or even thousands of employers. Therefore, a small error in one employer’s data will not have a significant impact on the overall data being reported.

Other D1 Fields

For those employers unfortunate enough to have to complete their own D1 or whose carrier/TPA requests additional information, here are some pointers on how to complete the remaining D1 fields:

| Field Names | Notes |

| Issuer or TPA Name/EIN | This should be the name and EIN of the insurance company who issues your fully insured policy or the TPA who administers your self-funded plan. Do not enter the employer’s name and number, unless the plan is both self-funded and self-administered. Do not enter more than one name or number – if there were multiple issuers/TPAs in the same year, they must be entered on separate lines. |

| State | For a fully insured plan, enter the two-letter postal code for the state where the policy was issued. For a self-funded plan, enter the two-letter postal code for the state of the employer’s principal place of business. |

| Market Segment | The market segments for group plans are: small group market; large group market; SF small employer plans; and SF large employer plans. Use the same definition of “small” used in your state to identify the small group fully insured market (typically less than 50 employees), even for a self-funded plan. Do not enter more than one market segment – if the employer offers multiple plans in different segments, e.g. both a self-funded and a fully insured plan, they should be listed on different lines. |

| Life years | Take the Total Member Months used to calculate Average Monthly Premiums, above, and divided by 12. Report the resulting number to the 8th decimal place. In the example above with 10,831 member months, the life years reported would be 902.58333333. |

| Earned Premium | This is the total amount of premiums paid to the insurance company for a fully-insured plan for the reference year; this field should be blank for a self-funded plan. This should be the same number used in the denominator when calculating Average Monthly Premiums. Do not reduce the premium to reflect MLR or other similar rebates. |

| Premium Equivalents | This is total cost of providing self-funded coverage for the year including claims costs, administrative costs, Administrative Services Only (ASO) and other TPA fees, and stop-loss premiums. Use the same costs that are used to calculate the COBRA premium except CMS expects the employer to use actual costs for the year, not expected costs, and don’t include the 2% admin fee. This should be the same number used in the denominator when calculating Average Monthly Premiums; this field should be left blank for a fully insured plan. |

| ASO/TPA Fees Paid | Report total ASO/TPA fees paid for a self-funded plan for the reference year – this amount should also be included in the premium equivalents amount. This field should be left blank for a fully-insured plan. |

| Stop Loss Premiums Paid | Report total stop loss premiums paid for a self-funded plan for the reference year – this amount should also be included in the premium equivalents amount. This field should be left blank for a fully-insured plan. |

While every effort has been taken in compiling this information to ensure that its contents are totally accurate, neither the publisher nor the author can accept liability for any inaccuracies or changed circumstances of any information herein or for the consequences of any reliance placed upon it. This publication is distributed on the understanding that the publisher is not engaged in rendering legal, accounting or other professional advice or services. Readers should always seek professional advice before entering into any commitments.

[1] But just because they can doesn’t always mean they will. In some cases, the carrier, TPA or PBM have indicated they will supply the necessary data but the employer must actually file the data with CMS themselves. Brokers and employers must check with each carrier, TPA or PBM how much they will file on the employer’s behalf and what portion of the filing remains the responsibility of the employer.